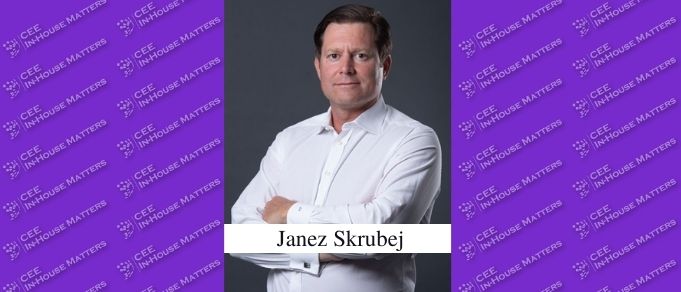

On February 2, 2022, CEE Legal Matters reported that Ketler & Partners, a member of Karanovic, had advised Invera Equity Partners on its acquisition of a 58.2% stake in Marles Hise Maribor. CEE In-House Matters spoke with Janez Skrubej, Partner at Invera Equity Partners, to learn more about the matter.

CEEIHM: Let's start with a few words about Invera Equity Partners.

Skrubej: Invera Private Equity Fund is a EUR 60 million PE fund headquartered in the Netherlands and focusing on the region of Southeastern Europe as its core investment territory. Invera’s investor base is made up solely of large, reputable institutional investors (EIF, EBRD, and pension and investment funds). Invera Equity Partners, fund manager of Invera Private Equity Fund, is seeking to acquire controlling interests in small and mid-sized enterprises, via buyouts or capital increases (or both), with the goal of achieving new levels of corporate strategy, market access, and technology. Currently, the fund has offices in Amsterdam, Ljubljana, Zagreb, and Sarajevo.

CEEIHM: What was the business case behind the acquisition – what made Marles Hise Maribor a particularly attractive target?

Skrubej: Marles is the oldest and largest Slovenian manufacturer of wooden prefabricated houses/buildings and for more than 50 years, has been a synonym for prefabricated houses not only in Slovenia but in the ex-Yu region as well. Throughout its history, there were 27,000+ individual wooden prefabricated buildings and 380+ kindergartens and schools constructed in Marles production sold across multiple markets (Austria, Slovenia, Italy, Switzerland, etc.). We believe that the sector of prefabricated buildings is very attractive due to its green component, ESG as well as future trends in the construction industry.

CEEIHM: What can we look forward to now, post-acquisition?

Skrubej: We aim to further strengthen the position of the company and its operations in existing markets (most notably Slovenia, Austria, Switzerland, Italy, and Germany), leverage its potential in cooperation with industry experts, increase production capacities, and open new opportunities in existing and new markets.

CEEIHM: What was the most complex aspect of this deal from a legal perspective?

Skrubej: We are all experienced in deal-making so we dealt with the usual complexity expected in such deals. It was very helpful that both parties had also very experienced legal advisors so we were able to focus on important matters from the start and overcome the usual nuances relatively quickly

CEEIHM: And why did you choose Ketler & Partners to advise you on this deal?

Skrubej: We wanted to have a strong legal advisor in our team and since we know and have very good experience with Marko Ketler from the past we decided to engage them. Marko also showed very strong personal dedication to the project which is always important in such deals.